Happy investors: getting money on the table

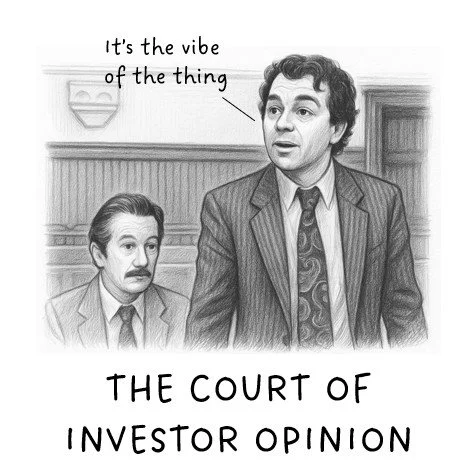

In The Castle, Darryl Kerrigan stands in court with nothing but his everyman judgment: a sense of fairness, legitimacy, and gut instinct. Against the odds, that’s what wins the day. It’s the vibe of the thing.

Making a funding request is not so different. You’re standing in the court of investor opinion. You put forward your evidence - the business case, the risk tables, the cost plans - but what really sways the decision is harder to pin down. It’s the vibe.

If an investment decision rests on the two traditional key tests - risk and reward - then what brings the vibe is surely alignment with reputation and purpose. When those line up, your proposal goes straight to the pool room.

Risk / Reputation

In the court of investor opinion, risk is always the first line of questioning, and reputation is the sharpest risk of all. Nobody wants their name tied to a dud.

Commercial investors see risk as part of the fun. They tolerate more uncertainty if the potential reward looks strong, and they often price that risk into their expectations.

Philanthropic investors frame risk through legacy and values, the linking of their name to safe, positive, and enduring outcomes. Hot tip: these investments are usually treated as charitable donation, so taxation can be an important consideration.

Government is more conservative, and for good reason. Big funding programs can be announced with little warning, with ministers expecting agencies to deliver outcomes yesterday. They need confidence that if they stand behind a project, it will hold up in the media and on the floor of parliament. They exert high pressure for governance expectations to be met quickly, minimising political exposure.

Reward / Purpose

In the court of investor opinion, reward is the closing argument. Purpose makes it stick – it turns numbers into conviction, and conviction unlocks the funding.

For commercial investors, purpose is profit. Growth, market share, cash returns need to be wrapped in a clear story that explains why this deal, why now, why them. Belief in the upside will help them tolerate more risk.

Philanthropic investors put purpose at the centre. Their reward is seeing their legacy made visible in the outcome: lives changed, communities strengthened, culture preserved. The real return is alignment with their values, but here taxation can sweeten the deal.

Government sees purpose through the lens of policy and politics. The payoff is an announceable they can stand behind: outcomes that are visible, defensible, and connected to ministerial priorities. Success is captured in performance frameworks and evaluation dashboards, the things they’ll point to in parliament or the press.

Reading the vibes

The real skill is developing your own judgment to read the signals early and adjust fast. If you can spot when confidence is building or slipping, you can act before the decision hardens either way. That’s how you keep the court of investor opinion in your corner.

Commercial and philanthropic investors:

Vibes are good >> the pressure is on, and the pace is fast. Terms and conditions are on the table, and you’re in regular, direct conversation.

Vibes are off >> the pressure lifts and doubts creep in. News comes through other people. It’s time to intervene, find out what’s gone sideways, and see if you can get their skin back in the game.

Government investors:

Vibes are good >> you’re in direct contact by phone, online meeting, and email. A relationship is building, and there’s a sense of camaraderie in your dealings.

Vibes are off >> requests shift to email, and frustration builds as interactions become hyper-detailed, risk-averse, or bogged down in process. This is your opportunity to intervene and reset the frame.

Be the bringer of good vibes

Reading the vibes is one part of the work, bringing them is another. Investors pick up confidence from the way you show up: how prepared you are, how well you’ve mapped their perspective, and how you tell the story. Think of it this way: the vibe starts with you.

Do your homework. Understand the mix of voices. Bring stories, not just numbers. Show you can manage surprises. Carry yourself with presence. These things keep the ‘why’ visible, which protects intent and keeps important stuff from getting cut. Holding the line is what keeps the vibe intact and the capital flowing.

I’ve worked on both sides of the investor and recipient partnership, releasing hundreds of millions in grants, submissions and proposals across the transport, infrastructure and cultural sectors. Keeping investors on side is as much about judgment and presence as it is about paperwork. If that is what you need more of, reach out.

The next article in this series drops 7 October. In Humming Delivery I’ll explore how to keep momentum once the money is flowing.